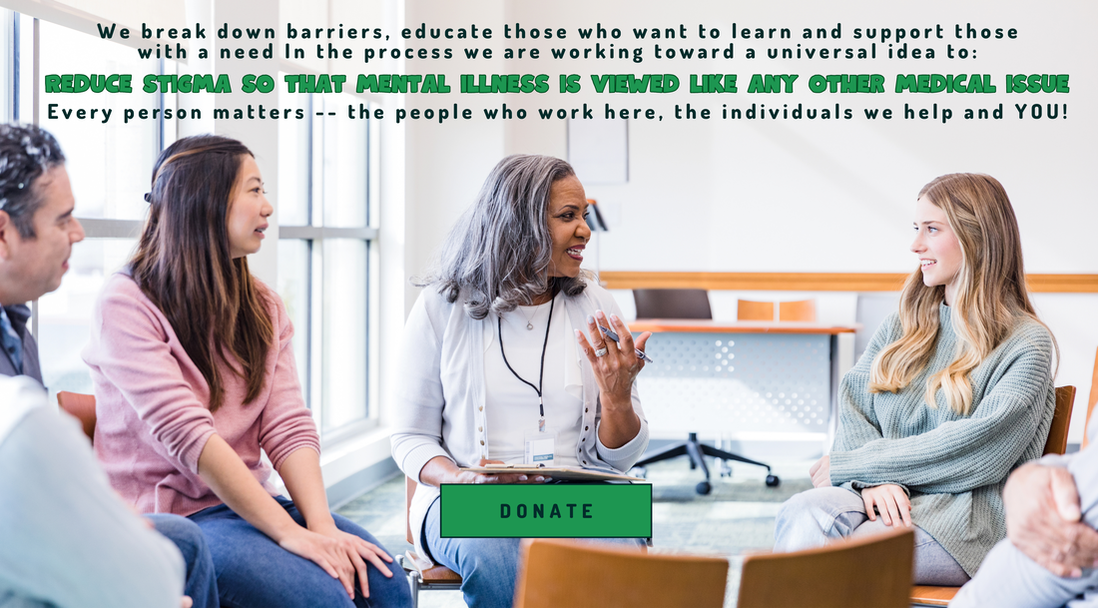

Give Today

The Mental Health Association in Atlantic County (MHAAC) is a non-profit organization dedicated to improving the behavioral health of people in our community through support, education and advocacy. Our work is important because mental illness affects not only the individual, but also his/her family members. Make a difference with a donation.

That's why we help both.

For Individuals: We offer once-on-one peer support so that individuals can meet personalized, meaningful goals that lead to real change. We also provide support groups and recreation opportunities for those living with mental illness because comradery makes a difference. Among the people we serve are those who are coping with depression, anxiety, bipolar disorder and eating disorders, and individuals with "too much stuff," which is how we like to describe hoarding disorder.

For Families: Family members receive assistance from an advocate who helps them understand their family member's illness and respond to challenging issues with a new perspective and informed approach. Families get answers to tough questions related to the healthcare system. We also offer monthly family meetings and social outings because we recognize the importance of talking, listening and feeling understood...and less alone.

We've been working and making a difference in our community for more than 50 years.

That's why we help both.

For Individuals: We offer once-on-one peer support so that individuals can meet personalized, meaningful goals that lead to real change. We also provide support groups and recreation opportunities for those living with mental illness because comradery makes a difference. Among the people we serve are those who are coping with depression, anxiety, bipolar disorder and eating disorders, and individuals with "too much stuff," which is how we like to describe hoarding disorder.

For Families: Family members receive assistance from an advocate who helps them understand their family member's illness and respond to challenging issues with a new perspective and informed approach. Families get answers to tough questions related to the healthcare system. We also offer monthly family meetings and social outings because we recognize the importance of talking, listening and feeling understood...and less alone.

We've been working and making a difference in our community for more than 50 years.

Planned Giving

Legacy Gifts - Including a Nonprofit in a Will

A will is one of the most sincere reflections of our own values. When people do estate planning, they often think about supporting causes, charities and organizations that have been important to them. A new bequest can dramatically increase in a nonprofit’s ability to have a positive impact on the community. By making the decision about where their money goes, people express what matters most to them.

For many individuals and families who entrusted staff at The Mental Health Association to provide guidance, the support they received was an essential and integral part of navigating challenging times. We are humbled by, but also proud of the many accomplishments and work we’ve done during the past 50 years in the critical areas of support, education and advocacy.

The Mental Health Association in Atlantic County has established the “MHNJ-AC Legacy Society” to honor people who have put a gift to us in their future plans. During our annual events, the agency will invite these members. Those who are willing to receive recognition for their generosity will be acknowledged.

Some points to consider are listed below.

Bequest:

Bequests are the transfers of wealth that occur upon a donor's death. Bequests can take several forms such as:

When you name a charity as a beneficiary to receive your IRA or other retirement assets upon your death, rather than donating retirement assets during your lifetime, the benefits are multitude:

How to designate a charity as the beneficiary of an IRA or 401(k)

When you’re ready, making a charity the beneficiary of your IRA or other retirement assets is typically straightforward: Fill out a designated beneficiary form through your employer or your plan administrator. Most banks and financial services firms also have beneficiary forms, or they can provide you with suggested language for naming beneficiaries to these accounts.

Once the designated beneficiary forms are in place, the retirement assets will generally pass directly to your beneficiaries (including charities) without going through probate.

If you are married, ask the plan administrator whether your spouse is required to consent. If required but not done, this could result in a disqualification of the charity as your beneficiary.

Be clear about your wishes with your spouse, lawyer and any financial advisors, giving a copy of the completed beneficiary forms as necessary.

By making a gift to MHANJ-AC through your will, trust or other financial plan, you can help us continue our work now and well into the future.

Donors can also name one or more nonprofits as beneficiaries of an insurance policy or as the recipient of an IRA or another qualified retirement fund.

Donating retirement assets as part of an estate plan: There can be significant tax advantages to donating retirement assets to charity as part of an estate plan. When done properly, charitable donations of retirement assets can minimize the amount of income taxes imposed on both your individual heirs and your estate.

How to do it:

Proposed language:

Below, please find suggested language and information in preparing your bequest. Please consult with an attorney, financial or estate planner in your preparation.

Tax ID# 22-1549749

Tax Status: not-for-profit 501(c)(3) corporation

Bequest Language: "I give to Mental Health Association NJ in Atlantic County, a New Jersey corporation with its principal offices at 4 East Jimmie Leeds Road, Suite 8, Galloway NJ 08205 USA, (the sum of $ ___ ) (all or ___ percent of my residual estate) to be used for its general purposes."

A will is one of the most sincere reflections of our own values. When people do estate planning, they often think about supporting causes, charities and organizations that have been important to them. A new bequest can dramatically increase in a nonprofit’s ability to have a positive impact on the community. By making the decision about where their money goes, people express what matters most to them.

For many individuals and families who entrusted staff at The Mental Health Association to provide guidance, the support they received was an essential and integral part of navigating challenging times. We are humbled by, but also proud of the many accomplishments and work we’ve done during the past 50 years in the critical areas of support, education and advocacy.

The Mental Health Association in Atlantic County has established the “MHNJ-AC Legacy Society” to honor people who have put a gift to us in their future plans. During our annual events, the agency will invite these members. Those who are willing to receive recognition for their generosity will be acknowledged.

Some points to consider are listed below.

Bequest:

Bequests are the transfers of wealth that occur upon a donor's death. Bequests can take several forms such as:

- Specific bequest - a certain amount of cash, securities, or property.

- General bequest - property that is similar to all other items distributed, usually cash.

- Percentage bequest - a stated percentage of the donor's estate.

- Residual bequest - all or a portion of what remains of the estate after specific and general bequests are distributed.

When you name a charity as a beneficiary to receive your IRA or other retirement assets upon your death, rather than donating retirement assets during your lifetime, the benefits are multitude:

- Income tax is not paid by you, your heirs nor your estate. This preserves wealth for your family.

- Your estate will receive a tax deduction for the charitable contribution (it will need to include the value of the assets as part of the gross estate, which can be used to offset the estate taxes).

- Because charities do not pay income tax, the full amount of your retirement account will directly benefit the charity.

- It’s possible to divide your retirement assets between charities and heirs according to any percentages you choose.

- You have the opportunity to support a cause you care about as part of your legacy.

- You have the opportunity to honor a family member, colleague or friend by making a tribute gift.

How to designate a charity as the beneficiary of an IRA or 401(k)

When you’re ready, making a charity the beneficiary of your IRA or other retirement assets is typically straightforward: Fill out a designated beneficiary form through your employer or your plan administrator. Most banks and financial services firms also have beneficiary forms, or they can provide you with suggested language for naming beneficiaries to these accounts.

Once the designated beneficiary forms are in place, the retirement assets will generally pass directly to your beneficiaries (including charities) without going through probate.

If you are married, ask the plan administrator whether your spouse is required to consent. If required but not done, this could result in a disqualification of the charity as your beneficiary.

Be clear about your wishes with your spouse, lawyer and any financial advisors, giving a copy of the completed beneficiary forms as necessary.

By making a gift to MHANJ-AC through your will, trust or other financial plan, you can help us continue our work now and well into the future.

Donors can also name one or more nonprofits as beneficiaries of an insurance policy or as the recipient of an IRA or another qualified retirement fund.

Donating retirement assets as part of an estate plan: There can be significant tax advantages to donating retirement assets to charity as part of an estate plan. When done properly, charitable donations of retirement assets can minimize the amount of income taxes imposed on both your individual heirs and your estate.

How to do it:

- Make a provision for MHANJ-AC in your will or trust [see proposed language below]

- Designate MHANJ-AC as a beneficiary of all or a portion of an insurance policy

- Designate MHANJ-AC as the beneficiary of an IRA or other retirement plan

Proposed language:

Below, please find suggested language and information in preparing your bequest. Please consult with an attorney, financial or estate planner in your preparation.

Tax ID# 22-1549749

Tax Status: not-for-profit 501(c)(3) corporation

Bequest Language: "I give to Mental Health Association NJ in Atlantic County, a New Jersey corporation with its principal offices at 4 East Jimmie Leeds Road, Suite 8, Galloway NJ 08205 USA, (the sum of $ ___ ) (all or ___ percent of my residual estate) to be used for its general purposes."

Please email MHAAC at MHAAC@mhanj.org or call 609-652-3800 ext. 307 to learn more about your legacy.

|

Mental Health Association in New Jersey, INC (MHANJ) makes every effort to post accurate and reliable information, however, it does not guarantee or warrant that the information on this Website is complete, accurate or up-to-date. This Website is intended solely for electronically providing information and convenient access to resources. All information is subject to change at any time without notice.Links to external websites are limited to State and Federal agencies and/or State and federally funded local programs. The existence of a link to any of these programs shall not constitute an endorsement of such program by the MHANJ.Unless otherwise noted on an individual document, file, Web page or other item, MHANJ grants user’s permission to reproduce materials published by MHANJ on this Website so long as MHANJ is noted as the source, and the date the Web page was accessed, along with the date of publication of the material cited, is noted. All copyright and other proprietary notices must be retained in the same form and manner as on the original and the contents may not be modified in any way. The user agrees to abide by all additional restrictions provided on this site as it may be updated from time to time.